33 Bottom Board CtRidgelandSC29936

Nearby investment properties with comparable rents

Nearby investment properties with comparable prices

Ziffy AI Summary

A quick, investor-focused snapshot highlighting income strength, yield potential.

| Key metrics | Value |

|---|---|

| Price | $399,900 |

| Est. Rent | $3,200/mo |

| ROI | 18% |

- Attractive rent-to-price ratio for income stability

- Good fit for DSCR financing with healthy coverage

Investment Highlights

Rental property for sale in Ridgeland at 33 Bottom Board Ct, Ridgeland, SC, 29936 priced at $373,490 converts $2,682/mo rent into $459/mo cash flow after a $1,828/mo obligation. Total monthly income equals $2,682/mo, and annual cash flow totals $5,505/yr on $123,812 invested. Return on cash invested prints 24.35% in year one, and rental yield reads 8.62% against a $373,490 entry. Equity gained on principal adds $2,410/yr, while 5% annual appreciation compiles into $103,188 by year five. Five-year ROI reaches 126.38% and total cumulative return in cash sums $156,477. For leverage, Ziffy Mortgage’s DSCR loan bases approval on $2,682/mo property income covering a $1,828/mo payment, not borrower’s personal income.

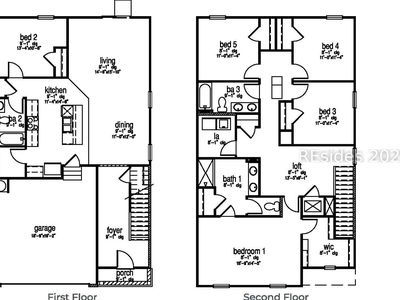

Single Family

Built in 2026

7,840 sqft lot

$N/A/sqft

No HOA

Neighborhood Data

Neighborhood data shown for ZIP Code: 29936, Ridgeland, SC area.

Housing Distribution

Housing Statistics

| Category | Value |

|---|---|

| Total HU (Housing Units) | 6,957 (100%) |

| Owner Occupied HU | 4,739 (68.1%) |

| Renter Occupied HU | 1,441 (20.7%) |

| Vacant Housing Units | 777 (11.2%) |

| Median Home Value | $277,227 |

| Average Home Value | $325,328 |

Housing Distribution

Address Breakdown

Residential

6,125

Single Family

5,494

Multi-Family

631

Businesses

766

Nearby investment properties with comparable rents

Nearby investment properties with comparable prices

Listed by: Kathy Ballowe • D R Horton Inc. (589)

Mls Name: REsides, Inc.

Mls Provider:

Mls ID: #503518

Disclaimer: We do not attempt to independently verify the currency, completeness, accuracy or authenticity of the data contained herein. It may be subject to transcription and transmission errors. Accordingly, the data is provided on an as is as available basis only and may not reflect all real estate activity in the market. 2025 REsides, Inc. All rights reserved. Certain information contained herein is derived from information which is the licensed property of, and copyrighted by, REsides, Inc.