Editorial Integrity

Making sound real estate investment decisions begins with reliable, data-driven insights. At Ziffy.ai, we offer an AI-powered investment property search platform, proprietary data-driven trend analysis, investment mortgage programs like DSCR loans, and a network of over 500 investor-friendly real estate agents to deliver the expertise needed for informed decisions. Our content is crafted by experienced real estate professionals and backed by real-time market data, ensuring you receive accurate and actionable information. Through a rigorous editorial process, we strive to empower your investment journey with trustworthy and up-to-date guidance.

Key Takeaways:

1. Ziffy Mortgage’s DSCR Loans lets you qualify for a mortgage based on your property’s rental income alone, without the need for a personal income verification.

2. DSCR is calculated by dividing gross rental income by monthly PITIA (Principal, Interest, Taxes, Insurance, and Association fees).

3. With DSCR Loans, you can scale your rental portfolio faster because these mortgages do not have traditional loan caps or DTI (Debt-to-Income) limits.

Table of Contents

Not every real estate investor fits the mold of traditional financing, but that shouldn’t get in the way of building or scaling your rental portfolio.

Maybe your income is unconventional, your tax returns don’t reflect your true earning potential, or you’re simply looking for a more flexible way to invest. These can make it difficult to secure conventional mortgages from traditional lenders.

That’s where Ziffy Mortgage’s DSCR loans come in. It looks at the property’s rental income, not your personal income to underwrite the loan.

In this guide, we’ll walk you through how DSCR loans work, what it takes to qualify in 2025, how to calculate your DSCR, and why this is one of the most scalable financing tools available to real estate investors today.

Whether you’re buying your first rental or financing your fifteenth, this is how you keep your strategy moving forward.

What is a DSCR Loan?

A DSCR Loan, short for Debt Service Coverage Ratio loan, is an investment mortgage option that allows you to qualify based purely on your property’s rental income, not personal income. There’s no need for tax returns, paystubs, or employment verification.

At Ziffy Mortgage, we underwrite DSCR loans by focusing on your property’s income potential. The key question we ask is:

Does the rent cover the monthly mortgage payment?

If the answer is yes, you are well on your way. While we primarily assess the property’s cash flow, we also review your US credit score to ensure a complete risk profile. It’s a streamlined process designed for serious investors.

Note: Can’t meet the required DSCR of 1 or higher?

You're not out of options. Ziffy Mortgage also offers a No Ratio DSCR loan for properties that may not currently meet the standard DSCR threshold but show strong income potential. However, you need to keep in mind that this option may require a higher down payment.

This makes DSCR Loan ideal for real estate investors who:

Now, let us see how to calculate DSCR.

How is DSCR calculated? [Or Skip the Math with Ziffy.ai]

When you apply for a DSCR Loan, the first thing that matters is the DSCR itself. This ratio tells us whether your property can cover its monthly loan payments using the rent it brings in.

The formula is pretty straightforward:

DSCR = Gross Rental Income / PITIA

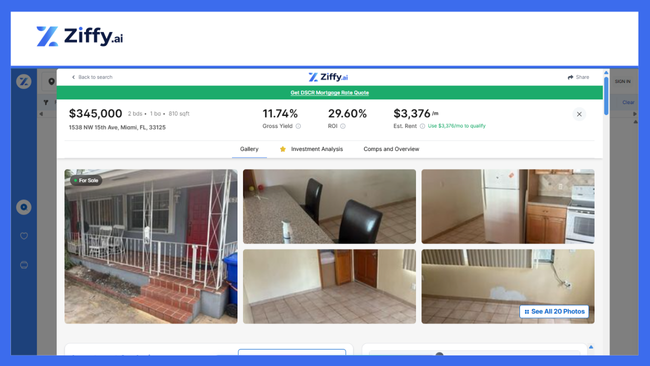

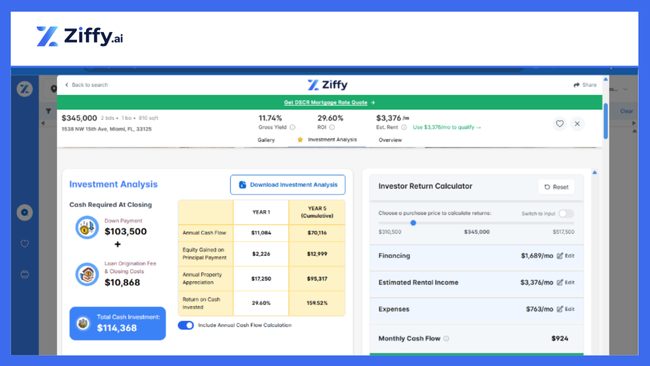

Let’s understand this with a simple example using this property in Miami, Florida listed on our Ziffy.ai platform:

- Estimated Monthly Rent: $3,376

- PITIA: $2,451

Now, DSCR for this property would be: $3,376 ÷ $2,451 = 1.38

This means the property earns 38% more than it needs to cover the full monthly payment.

Hate doing the math?

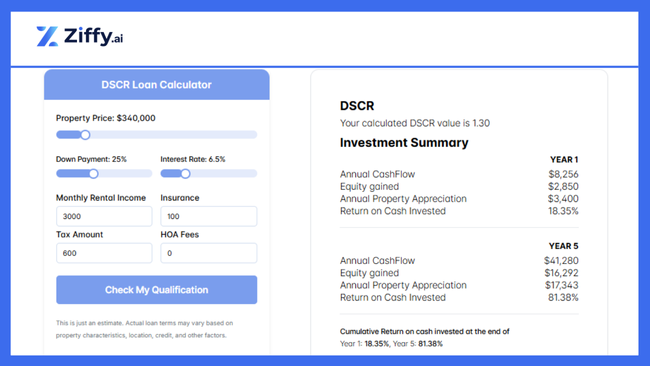

Ziffy.ai’s built-in DSCR calculator does the work for you. Our platform automatically checks your qualification based on rental income estimates, financing terms, and expense breakdowns.

You can even adjust your property price, down payment, interest rate, or expenses to see how the ratio shifts before you move forward.

DSCR Loan Requirements at Ziffy Mortgage

| Requirement | Details |

|---|---|

| Minimum DSCR | 1 or higher preferred. Properties below this may qualify under Ziffy’s No-Ratio DSCR Loan. |

| Down Payment | 20% |

| Credit Score | Minimum 620 |

| LTV Ratio | Up to 80% for Purchase and Rate/Term Refinance, Up to 75% for Cash Out Refinance |

| Loan Amount | $100K – $10M |

| Cash Reserves | 2 months |

| Property Use | Investment properties (residential and commercial) |

Ziffy Mortgage’s DSCR Loan vs. Traditional Mortgage: Why Investors Choose DSCR Loans?

Traditional mortgages were built for homeowners, not investors. They’re tied to your personal income, tax history, and employment status.

DSCR Loans, on the other hand, qualify you for the loan based on your property’s income.

Here’s how these two differ:

| Feature | Ziffy Mortgage DSCR Loan | Traditional Mortgage |

|---|---|---|

| Approval Based On | Property’s rental income (DSCR) | Your personal income, W-2s, and DTI |

| Tax Returns Required | Not required | Typically required for 2 years |

| Employment Verification | Not needed | Always required |

| DTI (Debt-to-Income) | Not considered | Key approval factor |

| Entity Type | Ideal for LLCs and business use | Personal use only |

| Speed of Approval | Faster, fewer documents | Slower due to full underwriting |

| Investor Flexibility | High; scale faster, even with multiple properties | Low; limited by income and property count |

With Ziffy.ai, you can browse properties, analyze your DSCR in real time, and apply for funding, all in one place. There’s no back-and-forth with personal documentation, and no bottlenecks when your portfolio grows.

If you’re investing for cash flow and long-term equity, DSCR loans are often the financing solution that actually matches your strategy.

From Property to Pre-Approval: Apply for DSCR Loan

Getting funded with a DSCR loan on Ziffy Mortgage is quick and transparent. Here’s how you can do it yourself in a few quick steps:

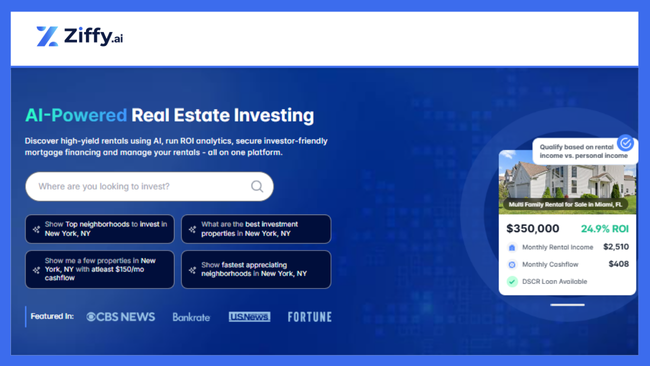

Discover High-Yield Investment Properties

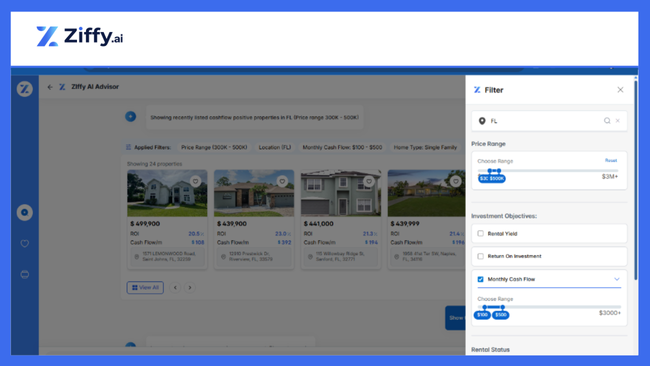

Start by entering your desired location, as soon as you do, ZiffyAI activates instantly to guide your search in real time.

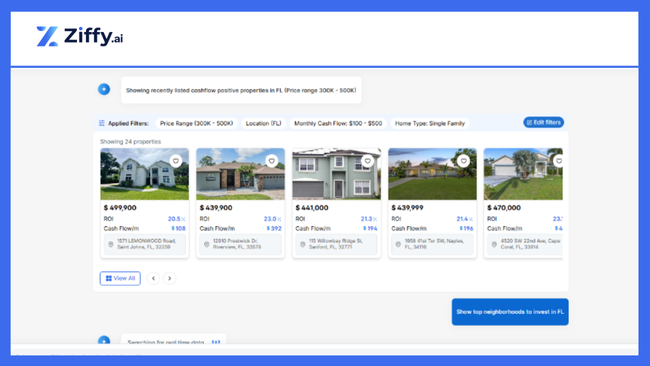

You’ll see personalized property results based on your price range, home type, and cash flow goals. The AI automatically applies filters like monthly cash flow and ROI, helping you surface listings aligned with your investment strategy.

And not only that, ZiffyAI doesn’t only show listings; it identifies markets with strong rental demand, limited inventory, and solid appreciation potential.

Whether you’re targeting consistent monthly cash flow or long-term equity growth, our data-backed suggestions help you focus on locations that support your goals.

Analyze Financial Metrics Instantly

Click into any listing to access a full financial breakdown and analysis. You can check projected rent, expenses, ROI, and more. To check whether you qualify, you can tweak metrics like estimated rental income and expenses to check your cash flow and see how the deal holds up.

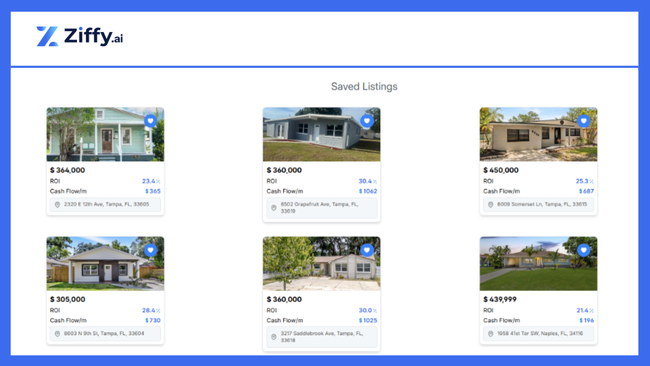

Save and Compare Investment Properties the Smart Way

Like the property you see? Save properties to your shortlist for later.

Ziffy.ai lets you compare key metrics like ROI and cash flow side by side. With our AI-driven technology, you are not only browsing listings, you are building a data-backed investment strategy.

Pre-Qualify Using Property Income

Once you have checked the numbers and are happy with it, pre-qualify for a DSCR loan directly from the listing. Ziffy doesn’t require tax returns or income docs.

We qualify you based solely on the property’s ability to cover the mortgage.

Connect with Investor-Friendly Agents

We also connect you with experienced agents who will help you with your investment.

Initiate the Loan Process and Close the Deal

Upload your documents to the portal. We’ll handle underwriting, appraisal, title, and closing. You can track all this through your Ziffy.ai dashboard. No back-and-forth or surprises.

Expand Your Portfolio

Once your loan is in place, you can track performance, explore refinance options, and roll equity into your next deal, all with the help of your Ziffy.ai dashboard.

Ready to Qualify Based on Your Investment Property’s Cash Flow?

The smartest investors know that good financing is just as important as a good deal. At Ziffy, we’ve built a platform that works the way you invest. From AI-driven investment property search to analysis to funding, everything happens in one place. No delays, no unnecessary documents, and no second guessing.

If you’re ready to scale your portfolio with confidence, Ziffy can help you take the first step toward closing your next cash-flowing investment.

FAQs

Who can qualify for a DSCR Loan at Ziffy Mortgage?

Any real estate investor buying or refinancing an income-generating property can qualify for a DSCR loan. Unlike traditional loans, you don’t need to show tax returns, paystubs, or employment proof. If your property’s rental income the monthly mortgage payment, you’re already in a strong position to qualify.

What does a “good” DSCR ratio look like?

A DSCR of 1 or higher means your property earns enough rent to cover its monthly payment. For example, a DSCR of 1.25 means your property makes 25% more income than needed to pay the mortgage. The higher your DSCR, the more comfortably your rental income supports the loan.

Can I get a DSCR loan if my property doesn’t meet the 1.0 ratio?

Yes. Ziffy Mortgage offers a No-Ratio DSCR Loan for properties that may not meet the standard ratio but still have strong potential. These loans may require a higher down payment or additional reserves, but they allow investors to move forward even when the property’s cash flow is still growing.

How is a DSCR Loan different from a traditional mortgage?

Traditional mortgages are based on your personal income and debt history. DSCR loans, however, focus on the property’s income. You won’t need to show W-2s or tax returns, and approval tends to be much faster. This makes them ideal for investors managing multiple properties through an LLC or business entity.

How do I check my DSCR before applying?

You can use Ziffy.ai’s DSCR calculator to see if your property qualifies. Just enter the estimated rent, purchase price, and loan details. The platform automatically calculates your ratio and even shows how changes in down payment or interest rate can affect your qualification.