1620 SE Barberry AveDallasOR97338

Nearby investment properties with comparable rents

Nearby investment properties with comparable prices

Ziffy AI Summary

A quick, investor-focused snapshot highlighting income strength, yield potential.

| Key metrics | Value |

|---|---|

| Price | $399,900 |

| Est. Rent | $3,200/mo |

| ROI | 18% |

- Attractive rent-to-price ratio for income stability

- Good fit for DSCR financing with healthy coverage

Investment Highlights

Investment property for sale in Dallas at 1620 SE Barberry Ave, Dallas, OR, 97338 earns $287/mo cash flow from $2,731/mo rent with a $1,982/mo payment. Total monthly income totals $2,731/mo, and annual cash flow totals $3,439/yr on $134,258 capital. ROI tracks 22.47% on current figures, and rental yield reads 8.09% at a $405,000 purchase. Equity gained on principal adds $2,613/yr, and 5% annual appreciation supports $111,894 over five years. Five-year ROI reaches 116.39% and total cumulative return in cash sums $156,266. Financing can be set up with Ziffy Mortgage’s DSCR loan, which is driven by $2,731/mo property income instead of your personal income.

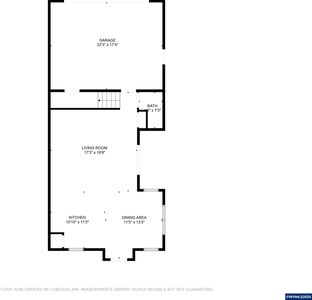

Townhouse

Built in 2020

2,614 sqft lot

$N/A/sqft

No HOA

Neighborhood Data

Neighborhood data shown for ZIP Code: 97338, Dallas, OR area.

Housing Distribution

Housing Statistics

| Category | Value |

|---|---|

| Total HU (Housing Units) | 9,715 (100%) |

| Owner Occupied HU | 6,971 (71.8%) |

| Renter Occupied HU | 2,440 (25.1%) |

| Vacant Housing Units | 304 ( 3.1%) |

| Median Home Value | $460,123 |

| Average Home Value | $495,328 |

Housing Distribution

Address Breakdown

Residential

9,322

Single Family

8,769

Multi-Family

553

Businesses

623

Nearby investment properties with comparable rents

Nearby investment properties with comparable prices

Listed by: SONYA GLESMANN • Berkshire Hathaway Homeservices R E Prof

Mls Name: WVMLS

Mls Provider:

Mls ID: #832068

Disclaimer: Based on information from Willamette Valley Multiple Listing Service, which neither guarantees nor is in any way responsible for its accuracy. All data is provided 'AS IS' and with all faults. Data maintained by Willamette Valley Multiple Listing Service may not reflect all real estate activity in the market.