Editorial Integrity

Making sound real estate investment decisions begins with reliable, data-driven insights. At Ziffy.ai, we offer an AI-powered investment property search platform, proprietary data-driven trend analysis, investment mortgage programs like DSCR loans, and a network of over 500 investor-friendly real estate agents to deliver the expertise needed for informed decisions. Our content is crafted by experienced real estate professionals and backed by real-time market data, ensuring you receive accurate and actionable information. Through a rigorous editorial process, we strive to empower your investment journey with trustworthy and up-to-date guidance.

Stretching a mortgage from 30 years to 50 sounds like it should help borrowers who were denied because their debt was too high for their income (DTI). But when we looked at 2024 HMDA data on more than 216,000 denied home-purchase applications in the 50 largest U.S. metros, the numbers told a different story.

Among 87,105 borrowers denied because of high debt-to-income ratios, fewer than 1% would have passed a standard 43% DTI test even with a 50-year mortgage. For the other 99%+, the answer would still be no.

Table of Contents

Key Highlights

How Little 50-Year Mortgages Change DTI-based Mortgage Denials

1. Even with 50-year mortgages, only 680 of 87,105 DTI-based denials (0.8%) would newly pass a 43% DTI test.

Across the 50 largest U.S. metros in this study, there are 89,652 mortgage applications where lenders cited debt-to-income (DTI) as a denial reason. For 87,105 of these, HMDA reports DTI clearly. Among that group, only 680 loans (0.8%) would move from “over” to “at or under” a 43% DTI limit if re-run as 50-year mortgages. Nationally in these metros, that means 99.2% of borrowers denied for DTI would still not meet a 43% DTI test even with half-century loans.

2. Around 4 in 10 mortgage denials involve DTI, but almost none would change outcome with a 50-year term.

At a national level across these 50 metros, DTI is a very common factor in denials, but ultra-long terms barely change the picture:

- Roughly 4 in 10 denied home-purchase applications are denied at least in part because of DTI.

- Yet only 680 out of 87,105 DTI-based denials (about 0.8%) would newly pass a 43% DTI test with a 50-year mortgage.

This means that 50-year mortgages hardly move overall denial outcomes, even though DTI itself is a major reason loans are turned down.

3. Roughly 94% of DTI-based denials are above 43% DTI, and about 86% cluster around very high DTIs of 55%-65%.

Within the 87,105 DTI-based denials where we can quantify DTI, about 94% are already above 43% DTI, and around 86% fall into HMDA’s top-coded bands that we represent as 55%-65% DTI. That means most DTI-based denials in this dataset are well beyond common underwriting cutoffs, not just a point or two over the line.

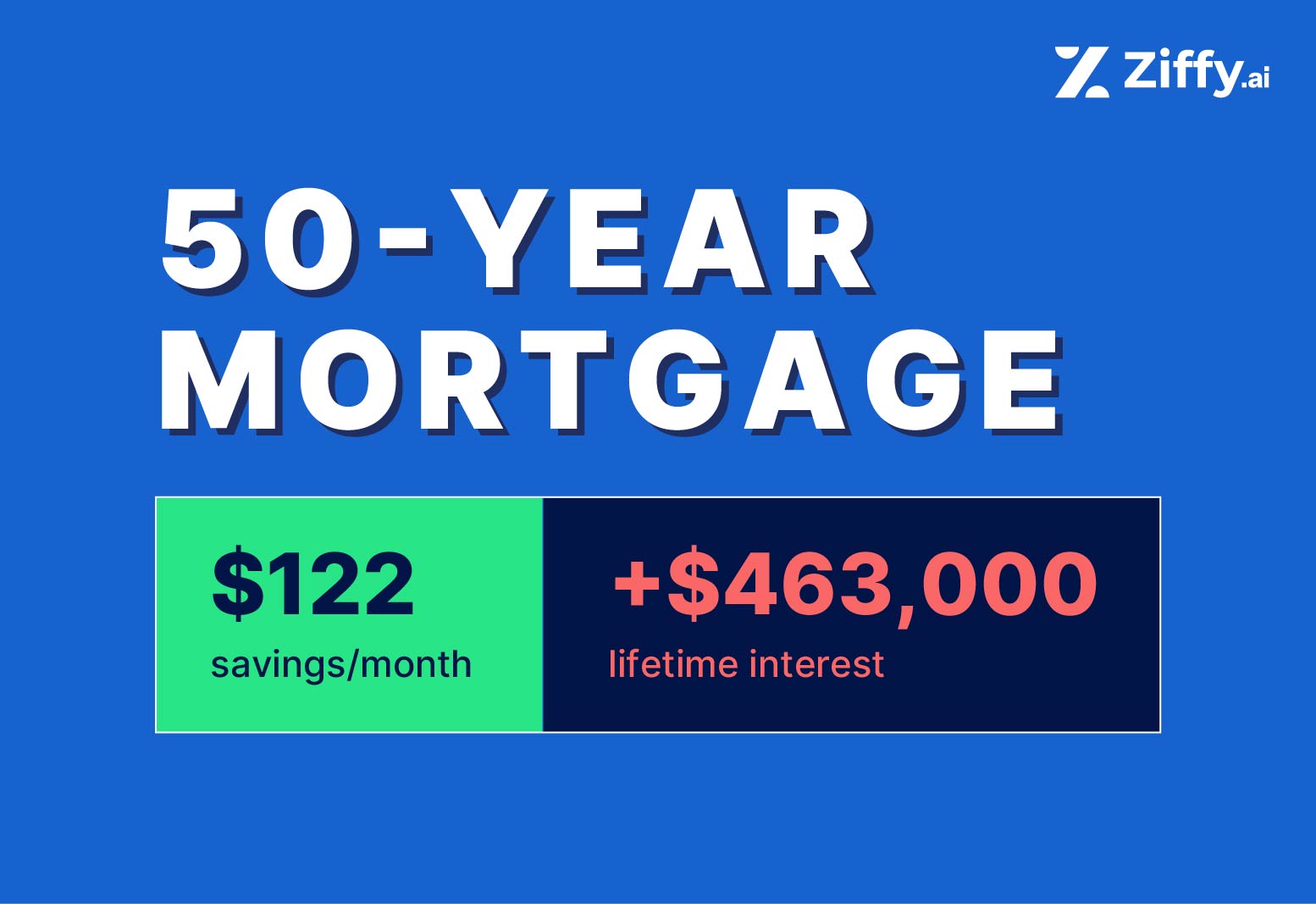

4. Stretching from 30 to 50 years cuts the mortgage payment by only about 5%, and total DTI by about 4%.

In our scenario, a 50-year fixed-rate mortgage at a slightly higher interest rate than a 30-year loan lowers the monthly principal-and-interest payment by about 5.4%. Once you blend that with non-mortgage debts (car loans, credit cards, student loans), the typical borrower’s overall DTI falls by only around 3–4%, enough to help a narrow band of borrowers just above DTI limits, but not those with very high debt loads.

5. Grand Rapids and Birmingham see the highest share of denials turning into potential passes, but more than 98% of DTI denials there still stay denied.

The biggest impact shows up in Grand Rapids–Kentwood, MI and Birmingham, AL, where the share of DTI-based denials that would newly pass a 43% DTI test under a 50-year mortgage reaches about 1.8%. In Grand Rapids, 22 out of 1,222 DTI-based denials would newly pass the DTI test; in Birmingham, 15 out of 850. Even in these metros with the largest modeled change, over 98% of borrowers denied for DTI would still not meet a 43% DTI limit.

The metros with the largest change (at a 43% DTI test) are:

Rank | Metro | DTI-based denials | Would newly pass 43% DTI (50-year) | Share of DTI denials that newly pass |

|---|---|---|---|---|

1. | Grand Rapids–Kentwood, MI | 1,222 | 22 | 1.8% |

2. | Birmingham, AL | 850 | 15 | 1.8% |

3. | San Francisco–San Mateo–Redwood City, CA | 235 | 4 | 1.7% |

4. | St. Louis, MO–IL | 1,196 | 19 | 1.6% |

5. | Seattle–Bellevue–Kent, WA | 785 | 11 | 1.4% |

6. Hartford and Oklahoma City are at the bottom, with only about 0.3% of DTI denials changing outcome under a 50-year term.

At the other end of the spectrum, Hartford–East Hartford–Middletown, CT and Oklahoma City, OK see almost no change at all. Hartford has just 1 loan out of 370 DTI-based denials that would newly pass a 43% DTI test with a 50-year mortgage, and Oklahoma City has 3 out of 1,089. That’s about 0.3% in each case, showing that in some markets ultra-long mortgages make virtually no difference to DTI-based denials.

7. In big metros like New York, Los Angeles, Houston, and Miami, more than 99% of DTI denials would still fail the DTI test even with a 50-year mortgage.

In large, familiar markets, the pattern is similar:

Metro | DTI-based denials | Would newly pass 43% DTI (50-year) | Share that newly pass | Still failing DTI after 50-year term |

|---|---|---|---|---|

New York–Jersey City–White Plains, NY–NJ | 2,769 | 20 | 0.7% | 99.3% |

Los Angeles–Long Beach–Glendale, CA | 2,729 | 19 | 0.7% | 99.3% |

Houston–Pasadena–The Woodlands, TX | 8,601 | 60 | 0.7% | 99.3% |

Miami–Miami Beach–Kendall, FL | 1,901 | 25 | 1.3% | 98.7% |

Even in high-cost, high-profile metros, 50-year mortgages turn only 0.7–1.3% of DTI denials into potential passes on a 43% DTI test.

8. Higher-income borrowers are more than twice as likely as lower-income borrowers to see a DTI denial change outcome, but the effect is still tiny.

Comparing borrower income to area median income (AMI), after filtering out clear outliers:

Income band (vs. AMI) | DTI-based denials | Would newly pass 43% DTI (50-year) | Share that newly pass |

|---|---|---|---|

Below 80% of AMI | 49,078 | 312 | 0.64% |

80–120% of AMI | 16,733 | 129 | 0.77% |

Above 120% of AMI | 17,331 | 232 | 1.33% |

Borrowers above 120% of AMI make up about 20% of DTI-based denials in this analysis but account for roughly one-third of the cases where a 50-year mortgage would change the DTI result. Even so, about 99% of high-income DTI denials still do not pass a 43% DTI test in the 50-year scenario.

9. Owner-occupiers see slightly more benefit than investors, but 99%+ of DTI-based denials in both groups still don’t clear the DTI bar.

By occupancy type:

Occupancy type | DTI-based denials | Would newly pass 43% DTI (50-year) | Share that newly pass |

|---|---|---|---|

Principal Residence | 81,521 | 655 | 0.80% |

Second Home | 1,339 | 8 | 0.60% |

Investor / Non-owner-occupied | 4,245 | 17 | 0.40% |

50-year mortgages provide slightly more DTI relief to primary-home buyers than to investors, but in all three categories, more than 99% of DTI-based denials still do not pass a 43% DTI test.

10. Younger and older borrowers see similar, modest changes; even among 65+ borrowers, fewer than 1 in 120 DTI denials would newly pass the test.

Grouping applicant ages into broader bands:

Age group | DTI-based denials | Would newly pass 43% DTI (50-year) | Share that newly pass |

|---|---|---|---|

18–34 | 27,420 | 233 | 0.85% |

35–44 | 24,020 | 190 | 0.79% |

45–54 | 17,490 | 137 | 0.78% |

55–64 | 11,335 | 64 | 0.56% |

65+ | 6,821 | 56 | 0.82% |

Even for borrowers 65 and older (a group unlikely to be offered a 50-year mortgage), fewer than 1 in 120 DTI-based denials would newly pass a 43% DTI test with a 50-year mortgage. That raises policy questions: how much extra time in debt is being traded for relatively small changes in who passes DTI screens?

Metro Ranking by Share of DTI-based Mortgage Denials that Turn into Potential Approvals (50-year term, 43% DTI)

Who 50-Year Mortgages Really Help and Who They Don’t

The data show that 50-year mortgages don’t unlock approvals for most denied borrowers, they only matter for a narrow group sitting just above common DTI cutoffs.

- Mostly “almost-qualifiers,” not deeply overextended borrowers.

The loans that change outcome are clustered right above the 43% DTI line. Borrowers with DTIs in the 50–65% range almost never move into passing territory, even when we stretch terms to 50 years.

- More relief for higher-income households than for lower-income ones.

Higher-income borrowers (those well above area median income) are more than twice as likely as lower-income borrowers to see a DTI denial turn into a potential pass, but even in this group, roughly 99% of DTI-based denials still don’t clear the 43% DTI test. Ultra-long terms mostly help households stretching for more expensive homes, not the borrowers with the heaviest debt burdens.

- Small, similar effects across age and occupancy.

Younger and older borrowers, owner-occupiers versus investors all see changes on the order of around 1% or less of DTI-based denials. In every group, well over 98–99% of DTI denials remain denials. The 50-year term doesn’t reshape who passes DTI screens; it only nudges a very narrow slice of borrowers sitting just above common DTI cutoffs.

Methodology

Data Source & Scope

This analysis combines:

- Population data from the U.S. Census Bureau, using 2024 population estimates to identify the 50 largest U.S. metropolitan areas.

- Loan-level mortgage data from the 2024 Home Mortgage Disclosure Act (HMDA) dataset.

We focus on:

- Loan purpose: Home purchase

- Action taken: Application denied

- Geography: HMDA MSA/MD (Metropolitan Statistical Area / Metropolitan Division) codes chosen to approximate the 50 largest U.S. metros by 2024 population, based on the U.S. Census Bureau list.

- For each metro on the Census list, we selected the closest HMDA MSA/MD based on the primary city name (for example, using “New York–Jersey City–White Plains, NY–NJ” to stand in for the broader New York metro).

After downloading and combining the relevant 2024 HMDA extracts for those 50 HMDA geographies, the final dataset includes:

- 216,338 denied home-purchase applications across those 50 metro areas.

All statistics in this report refer to this combined 2024 HMDA dataset unless otherwise noted.

How We Defined DTI-Based Denials

From the 216,338 denied applications, we identify DTI-based denials using standard HMDA fields:

- action_taken == 3 → Application denied (already true for all loans in this dataset), and

- Any of the denial reason fields:

- denial_reason-1

- denial_reason-2

- denial_reason-3

- denial_reason-4

equals 1, which HMDA codes as Debt-to-income ratio (DTI).

Using this definition:

- 89,652 denied applications list DTI as at least one denial reason.

This is the DTI-denial pool. All of the “50-year mortgage” results in this report are about this group only.

The Simulation Sample (87,105 Loans)

HMDA often reports DTI as a band or category rather than a precise percentage, and sometimes as “Exempt” or “NA”. To model how DTI would change under a 50-year term, we need to convert those codes into numeric values.

We therefore restrict the DTI-denial pool to loans where debt_to_income_ratio can be mapped to a number:

- We keep loans where DTI is reported as:

- A numeric percentage (for example, “44” for 44%), or

- A categorical band that can be translated into a representative percentage (for example, “40-<45”).

- We exclude loans where DTI is:

- Missing,

- “Exempt”, “NA”, or another non-numeric code that cannot be reasonably interpreted.

After this step:

- DTI-based denials used in the analysis: 87,105 loans

- DTI-based denials excluded due to unmappable DTI: 2,547 loans

All of the “0.8%” and metro-level “would newly pass” figures in this report are based on this analytic sample of 87,105 DTI-based denials.

Using HMDA’s DTI as the Baseline

HMDA’s debt_to_income_ratio field represents the back-end DTI lenders used in underwriting:

Back-end DTI = total monthly debt obligations ÷ total monthly income relied upon.

This already includes:

- Mortgage-related obligations (principal, interest, taxes, insurance, HOA), plus

- Non-mortgage debt (auto loans, credit cards, student loans, personal loans, etc.).

We treat this HMDA-reported DTI as the starting point for each loan’s DTI, and then model how that DTI would change if the mortgage term is extended to 50 years at a different interest rate, holding income and non-mortgage debts constant.

Mapping DTI Categories to Numbers

HMDA often reports DTI in bands such as:

- <20%

- 20-<30%

- 30-<36%

- 36-<40%

- 40-<45%

- 45-<50%

- 50-60%

- >60%

We map these bands to representative numeric values:

- <20% → 0.18

- 20-<30% → 0.25

- 30-<36% → 0.33

- 36-<40% → 0.38

- 40-<45% → 0.43

- 45-<50% → 0.48

- 50-60% → 0.55

- >60% → 0.65

For entries like “44”, we interpret them as 44% DTI and convert to 0.44.

The result is a numeric baseline DTI, which we call:

- DTI_baseline

for each loan in the simulation sample.

This approach necessarily compresses variation at the top end, where many loans are top-coded into 50–60% or >60%, but it reflects the level of detail available in 2024 HMDA data.

Rate and Term Assumptions

We are not trying to reconstruct each borrower’s original interest rate or term. Instead, we impose a standardized, forward-looking scenario designed to reflect a current, relatively high-rate environment.

- 30-year scenario (baseline):

- Term: 30 years (360 months)

- Nominal rate: 6.24%, as of Nov 21st, 2025, Freddie Mac

- 50-year scenario (ultra-long):

- Term: 50 years (600 months)

- Nominal rate: 6.74%

- This rate is set exactly 0.50 percentage points above the 30-year Freddie Mac rate to reflect a plausible risk premium for 50-year fixed-rate mortgages.

The 6.24% rate is observed market data from Freddie Mac; the 6.74% rate is a modeled extension based on a 0.50 percentage point step-up.

How We Model the Payment Change

For each scenario, we compute the standard fixed-rate mortgage payment per $1 of principal using the usual amortization formula:

Payment = [ r × (1 + r)^n ] ÷ [ (1 + r)^n – 1 ]

where:

- r is the monthly interest rate (annual rate ÷ 12), and

- n is the total number of monthly payments.

For the two cases:

- 30-year at 6.24% (Freddie Mac rate)

- r30 = 0.0624 / 12

- n30 = 360

- Payment per $1 of principal:

- payment30_per_1 ≈ 0.00615

- 50-year at 6.74% (modeled as 30-year + 0.50%)

- r50 = 0.0674 / 12

- n50 = 600

- Payment per $1 of principal:

- payment50_per_1 ≈ 0.00582

We then define a payment ratio:

k = payment50_per_1 ÷ payment30_per_1 ≈ 0.946

This means that, for each dollar of loan amount, the 50-year mortgage payment is about 5.4% lower than the 30-year payment in this Freddie Mac–anchored rate scenario.

Mortgage Share of DTI (w)

Back-end DTI is made up of:

- A mortgage portion (principal, interest, taxes, insurance, HOA), and

- A non-mortgage portion (other debt payments).

Industry rules of thumb suggest that housing costs usually account for around 70–80% of back-end DTI:

- Conventional “28/36” guideline (28% front-end / 36% back-end) implies about 78% of DTI is housing-related.

- FHA “31/43” guideline (31% front-end / 43% back-end) implies about 72% housing.

Based on that, we assume:

- Primary case:

- w = 0.70 → 70% of back-end DTI is mortgage-related.

- Conservative sensitivity:

- w = 0.50 → 50% of back-end DTI is mortgage-related, implying a larger role for non-mortgage debt and thus smaller DTI benefit from term extension.

These values are applied uniformly across loans; we do not attempt to estimate a borrower-specific w.

Translating Payment Changes into DTI Changes

We assume:

- The mortgage portion of DTI shrinks in proportion to the payment ratio k.

- The non-mortgage portion of DTI stays the same (we assume no change to car payments, credit cards, student loans, etc.).

- Total income also stays the same.

Given:

- DTI_baseline = HMDA back-end DTI (numeric)

- w = share of DTI from the mortgage (0.70 in the primary case)

- k ≈ 0.946 = payment ratio

we define the modeled 50-year DTI as:

DTI_50(w) = DTI_baseline * (w * k + (1 – w))

Interpretation:

- The mortgage portion (the w share of DTI) is multiplied by k (because the payment is lower).

- The non-mortgage portion (the 1 – w share) is unchanged.

- Together this gives the new total back-end DTI under the 50-year scenario.

Under the primary case (w = 0.70):

- The combined factor w * k + (1 – w) is approximately 0.962, meaning total DTI falls by about 3.8%.

Under the conservative case (w = 0.50):

- That factor is approximately 0.973, meaning total DTI falls by about 2.7%.

Because HMDA records DTI in relatively coarse bands, both assumptions deliver almost the same classification results: they push a small band of loans just over the cutoff to just under it, but have almost no effect on loans that are far above the threshold.

DTI Thresholds and “Newly Passing” Loans

We evaluate DTI outcomes against three common back-end DTI thresholds:

- 43% (primary threshold; often associated with Qualified Mortgage rules)

- 45% (a somewhat looser but still common cutoff)

- 50% (a stress/sensitivity line)

For each loan and each threshold, we classify the outcome as:

- Would newly pass (i.e., denial might turn to yes on DTI grounds) if:

- DTI_baseline is above the threshold, and

- DTI_50(w) is at or below the threshold.

- Still failing DTI if:

- DTI_50(w) remains above the threshold.

In the primary scenario (w = 0.70, 43% threshold):

- 680 out of 87,105 DTI-based denials would newly pass the 43% DTI test under a 50-year mortgage.

- This is 0.8% of the analytic sample.

- The other 99.2% remain above 43% DTI.

At a 45% threshold, some additional loans move under the line; at 50%, essentially no additional loans change status in this dataset, because the modeled DTI reduction is too small relative to how far most borrowers sit above 50%.

Segmentation: Income, Age, and Occupancy

To understand who is affected, we group loans using standard HMDA-derived fields:

Income vs. area median income (AMI)

- income is treated as annual income in thousands of dollars, and ffiec_msa_md_median_family_income is area median family income in dollars.

- We first keep loans where both fields are present and greater than zero.

- We then compute an AMI ratio as:

AMI ratio = (income * 1,000) / ffiec_msa_md_median_family_income.

To remove obvious outliers and placeholder values, we drop loans where the AMI ratio is less than or equal to 0 or greater than 10 (that is, reported income more than 10× area median income). This removes 136 loans, about 0.2% of those with usable AMI data.

- The remaining loans are grouped into:

- Below 80% of AMI

- 80–120% of AMI

- Above 120% of AMI

Loans removed by this AMI outlier filter are still included in the national and metro-level DTI denial counts; they are excluded only from the income-band segmentation.

Age

- applicant_age is grouped into:

- 18–34

- 35–44

- 45–54

- 55–64

- 65+

using HMDA’s age bands (for example, 25–34, 35–44, 65–74, >74).

Occupancy type

- occupancy_type distinguishes:

- Principal residence (owner-occupied)

- Second home

- Investment / non–owner-occupied

Not all loans have complete information for all fields. Where data are missing or implausible (for example, missing AMI or clearly placeholder values), those loans are excluded from that particular breakdown but still included in the broader national and metro totals.