Editorial Integrity

Making sound real estate investment decisions begins with reliable, data-driven insights. At Ziffy.ai, we offer an AI-powered investment property search platform, proprietary data-driven trend analysis, investment mortgage programs like DSCR loans, and a network of over 500 investor-friendly real estate agents to deliver the expertise needed for informed decisions. Our content is crafted by experienced real estate professionals and backed by real-time market data, ensuring you receive accurate and actionable information. Through a rigorous editorial process, we strive to empower your investment journey with trustworthy and up-to-date guidance.

Key Takeaways:

1. Define your investment goals before searching to align your strategy with the right property type and market.

2. Use Ziffy.ai’s AI-driven filters and investment analysis to find and compare high-performing properties instantly.

3. Evaluate key market indicators like rent growth, vacancy rates, and population trends before investing.

4. Get tailored financing options like DSCR, bridge, or fix-and-flip loans directly on Ziffy to match your investment plan.

5. Ziffy.ai brings property search, ROI analysis, and financing under one platform, helping you move from research to purchase with confidence.

Table of Contents

Finding your first investment property can feel overwhelming. There are endless listings to scroll through, but not every property will generate strong returns. The key is to begin with clear goals and use the right tools to connect those goals with properties that perform.

This guide breaks down the process step by step. You will learn how to define your investment goals, choose a strong market, run the numbers, and search for properties that align with your plan.

With Ziffy.ai’s AI-driven investment property search and built-in analysis, you can move from browsing to investing with confidence.

Step 1: Define Your Real Estate Investment Goals

Before you look at listings or calculate returns, clarify your “why.” What you want from your investment will guide the type of property you choose, the market you enter, and how you evaluate opportunities.

What Are You Investing For?

Here are some key questions you should ask yourself:

Clear answers will help you avoid distractions from properties that look attractive but do not align with your strategy.

Match Your Strategy to the Property Type

Here’s how your goals might match different property profiles:

Goal | Property Focus | Key Metrics to Watch |

|---|---|---|

Cash Flow | Turnkey rentals, multi-family | Cap rate, rental yield, cash-on-cash return |

Appreciation | Single-family homes in growing markets | Population growth, job growth, days on market |

Value-Add | Fix and flip, BRRRR investment | After-repair value, rehab costs, margin |

Short-Term Returns | Vacation rentals, furnished units | Daily occupancy rate, seasonal demand |

How to set goals?

If your goal is steady income, you might define it as:

“I want a property that brings in at least $250 in monthly cash flow after expenses. I will target a market with low vacancy rates and strong rental demand, and I plan to hold for at least five years.”

Once you have that clarity, here’s how you can look and search for the property listing on Ziffy:

Search and Analyze Investment Properties on Ziffy.ai

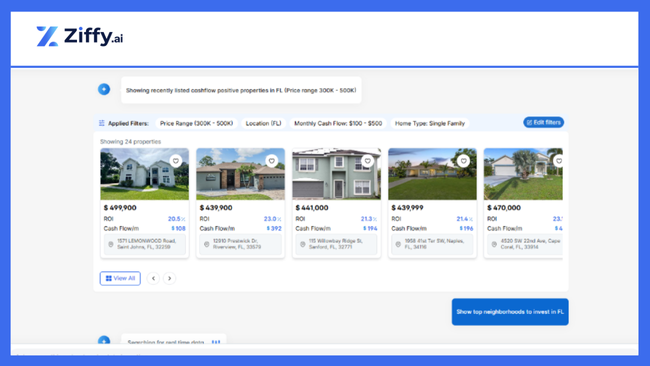

- Start with a Location and Let ZiffyAI Generate Results

Begin by entering the location where you want to invest. ZiffyAI instantly produces a curated list of cash-flowing properties that meet your criteria.

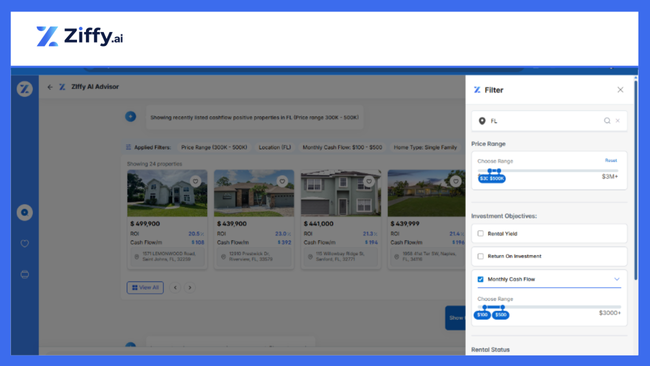

You do not need to set every filter manually. ZiffyAI applies smart defaults such as price, cash flow, and home type so that your results already align with typical investment goals. You can adjust filters at any time to fine-tune your search.

- Search High-Performing Markets

Not sure where to start? Ask ZiffyAI directly and it will highlight neighborhoods with strong demand, balanced supply, and positive trends. This reduces the time spent on manual research and puts you in front of markets where investors are most active.

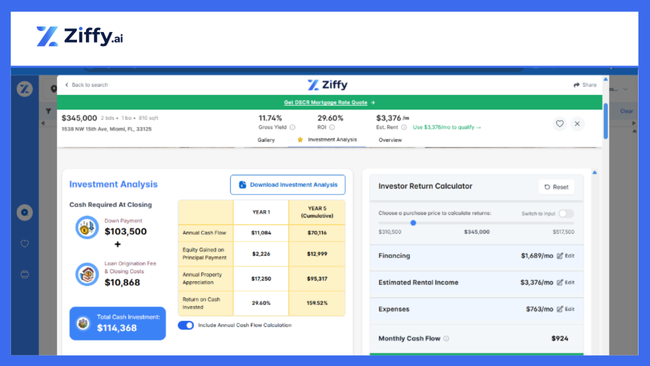

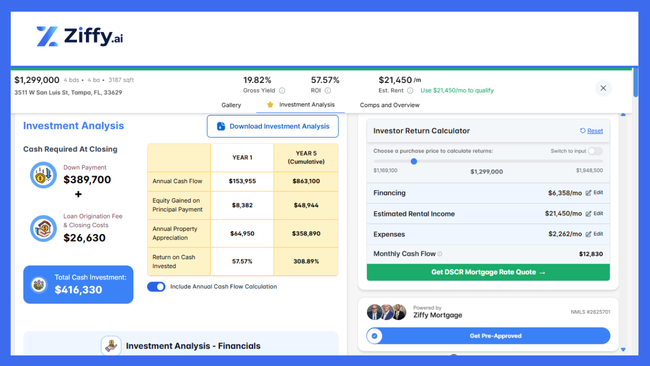

- Run Instant Investment Analysis

Click into any property listing and check the investment analysis.

You will see projected rent, expenses, cash flow, and ROI based on the property details. This makes it easy to check if a property meets your target, such as $250 in monthly cash flow.

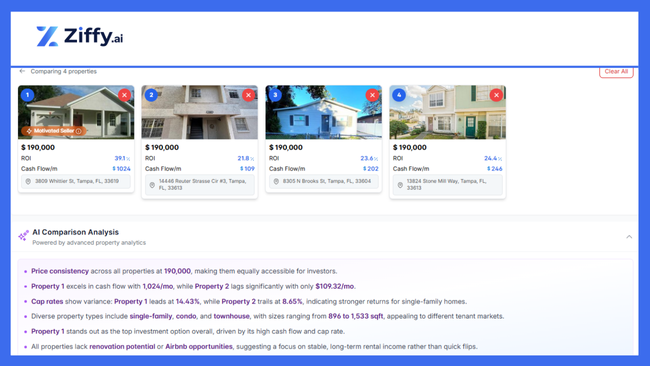

- Save and Compare Top Options

If a property looks promising, add it to your shortlist. Ziffy.ai allows you to compare multiple listings side by side so you can weigh cash flow, ROI, and financing options before making a decision.

Step 2: How to Choose the Right Real Estate Market for Investment

Picking the right location is just as important as picking the right property.

The market you select will shape your rental income, appreciation potential, and long-term returns. Whether buying locally or out of state, choosing the right market gives you the strongest foundation.

What Makes a Market “Investor-Friendly”?

Here are a few key indicators that signal a strong real estate investment market:

You can check many of these factors in real time with ZiffyAI, which highlights top-performing markets and neighborhoods based on live data. Click here to go directly to ZiffyAI.

Additionally, we recently analyzed the top US cities with the highest ROI in 2025. These markets stood out for their mix of appreciation potential, rent growth, and overall investor performance.

If cash flow is your priority, you’ll also want to review our guide on the top US cities with the highest rental yields. It breaks down where rental income is strongest relative to purchase price, which is a key metric for long-term income investors.

Step 3: Set Your Budget and Financing Plan for Real Estate Investment

Before you fall in love with a property, you need to know what you can realistically afford. That includes not only the purchase price but also monthly costs, reserves, and financing.

Know Your Numbers

Start by breaking down a few key financial components:

A common guideline is the 1% rule: look for properties where monthly rent equals at least 1% of the purchase price. While not absolute, it helps you filter for stronger cash flow.

Financing Options For Real Estate Investors That Align With Your Strategy From Ziffy Mortgage

There’s no one-size-fits-all loan for investors. Different investment strategies call for different financing options. Here’s a quick breakdown:

Loan Type | Ideal For | Key Feature |

|---|---|---|

Full Documentation | W-2 earners with strong credit | Lower rates, stricter income verification |

DSCR Loan | Cash-flow-focused investors | Based on property’s rental income, not personal income |

Bridge Loan | Short-term opportunities | Quick funding, ideal for flipping or refinancing later |

Fix and Flip Loan | Rehab-focused investments | Covers both purchase and renovation costs |

As you evaluate properties on our AI-driven investment property search platform, you’ll see mortgage options that match your selected investment type. You can check loan terms, see what you might qualify for, and even start the pre-approval process without moving between different platforms.

Let’s take an example:

You find a single-family rental in Kansas City with strong projected rent. Instead of guessing whether the financing will work, you check loan options through Ziffy and run a quick analysis based on your preferred loan type.

After checking your qualification. you see that a DSCR loan could cover the purchase with a monthly cash flow margin that meets your target. That clarity helps you decide whether to move forward or keep searching.

By finalizing your financing plan early, you’ll be in a position to act quickly when the right opportunity comes up and avoid scrambling later when it’s time to close.

Step 4: What to Do After You Find the Right Investment Property

Once you find a property that meets your goals, confirm the numbers. Check projected rent against comparable properties, verify all monthly costs, and ensure ROI matches your expectations.

Ziffy.ai streamlines this step by letting you re-run the analysis, review financing options, and request pre-approval directly on the platform. Being prepared early on puts you in a stronger position when it is time to make an offer.

Conclusion

Finding the right investment property isn’t just about luck or instinct, It’s about knowing what you’re looking for and using the right tools to find it. By setting clear goals, choosing the right market, understanding your budget, and analyzing each investment property, you’re already ahead of the curve.

You don’t need ten tabs open, a gigantic excel sheet, or a team of analysts to get started. With Ziffy.ai, you’ve got everything in one place. From AI-driven investment property search platform, smart search filters and investment analysis to financing options tailored to investors.

Whether you’re buying your first rental or adding to your portfolio, the process gets a whole lot simpler when it’s built for how investors actually think.

FAQs

What’s the best way to start searching for an investment property as a beginner?

Start by defining your investment goals: are you looking for cash flow, appreciation, or both? Then choose a market that supports those goals, set a realistic budget, and begin searching using filters like ROI, rental yield, and property price on platforms like Ziffy.

How can I tell if a property is a good investment?

A good investment typically shows strong rental income compared to its price, is located in a market with growing demand, and aligns with your financial targets. Tools like Ziffy’s Investment Analysis help you calculate expected cash flow, cap rate, and ROI before you commit.

Do I need to be pre-approved before searching for properties?

You don’t need to be pre-approved to start searching, but having a financing plan in place early helps you move faster and make stronger offers. Ziffy lets you finalize your investment loan options and start the pre-approval process directly on the platform.

What should I compare when evaluating markets?

Focus on population and job growth, vacancy rates, average rents, home prices, and local laws. These indicators give you a good sense of rental demand and long-term upside.

Can I use Ziffy if I’m just exploring and not ready to buy?

Absolutely. Many investors use Ziffy to learn the market, run sample investment analyses, and watch how different cities are performing before jumping in. It’s a great way to build confidence before your first purchase.