Editorial Integrity

Making sound real estate investment decisions begins with reliable, data-driven insights. At Ziffy.ai, we offer an AI-powered investment property search platform, proprietary data-driven trend analysis, investment mortgage programs like DSCR loans, and a network of over 500 investor-friendly real estate agents to deliver the expertise needed for informed decisions. Our content is crafted by experienced real estate professionals and backed by real-time market data, ensuring you receive accurate and actionable information. Through a rigorous editorial process, we strive to empower your investment journey with trustworthy and up-to-date guidance.

Key Takeaways:

1. Real estate is one of the most reliable ways to build long-term wealth in the US. It gives you control over your strategy, helps protect against inflation, and allows you to use financing to grow faster.

2. Ziffy.ai makes real estate investing easier by helping you find, compare, and analyze properties using real data and clear insights so you can invest with confidence.

3. Your strategy should fit your goals and lifestyle. Whether you want steady rental income, quick profits from flips, or to live in one unit and rent the rest, success starts with a clear plan.

4. Smart investing begins with understanding your market and your numbers. Ziffy.ai helps you see how each property performs so you can choose investments that truly build long-term value.

Table of Contents

Real estate is one of the most reliable ways to build wealth in the US. Unlike stocks or bonds, it gives you control over your strategy, the ability to use financing to scale your portfolio, and protection against inflation. But for beginners, the challenge is knowing where to start.

This guide breaks down the basics of real estate investing into clear steps any beginner can follow. You’ll learn how to set investment goals, choose the right strategy, evaluate properties, and secure financing with confidence.

And with Ziffy.ai, you get AI-powered investment property search, data-backed filters, and live market insights that help you make clear investment decisions from day one.

What Is Real Estate Investing?

Real estate investing is the practice of buying property with the goal of building long-term wealth. That can mean earning steady income from rentals, flipping for quicker profits, or holding on to a property as its value grows.

Beyond returns, real estate offers unique advantages that set it apart from other investment options:

Put simply, real estate investing is about using these advantages to align property decisions with your financial goals, whether that means stable cash flow, portfolio diversification, or long-term appreciation.

Property Types You Can Invest In Using Ziffy.ai

Not all properties are built equal when it comes to generating income and long-term value.

On Ziffy.ai, every listing is pre-evaluated for investor-grade potential, giving you a clear view into what each property type offers.

| Property Type | What It Includes |

|---|---|

| Residential | Single-family homes, condos, townhomes |

| Multifamily | Properties with 2 to 4 units (residential), or 5+ (commercial) |

| Commercial | Office spaces, retail units, mixed-use buildings |

Common Real Estate Investment Uses You Can Explore on Ziffy.ai

Your real estate investment strategy should match your financial goals, and Ziffy.ai is built to help you get there.

Here are some of the most popular ways investors are using real estate to build wealth:

- Rental Income: Buy and hold to generate steady monthly cash flow.

- Fix and Flip: Renovate undervalued properties and sell them for a profit.

- Appreciation: Hold property in a promising market and sell when values rise.

- House Hacking: Live in one unit, rent out the others to offset your mortgage.

Whatever your approach, Ziffy.ai helps you search smarter with AI-driven investment property search, run the numbers faster, and manage the investment with confidence.

How to Match Your Real Estate Strategy with Your Investment Goals

The best investment strategy isn’t the one that makes the most noise, it’s the one that fits your goals, lifestyle, and risk comfort.

For example, flipping houses might seem profitable, but without the time or experience to manage renovations, it can quickly become overwhelming.

On the other hand, long-term rentals are a great way to build wealth steadily, but they may not suit you if you’re hoping for faster returns. What matters most is choosing a path that fits both your current situation and your long-term goals.

Here are some questions you need to ask yourself:

- Do I want steady monthly income or faster, one-time gains?

- How much time can I realistically commit to this?

- Am I comfortable taking on risk, or do I want something more stable?

- What’s my budget, and how much financing will I need?

- Am I investing to grow slowly or scale aggressively?

Once you’re honest about those answers, the right strategy usually reveals itself.

For example, if you’re working full-time and want a hands-off income stream, a buy and hold rental in a reliable market might be a great fit. If you have some capital, contractor contacts, and a good eye for potential, flipping could work.

And if you’re looking for a creative way to start small, house hacking lets you live in one unit while renting out the others to cover your mortgage.

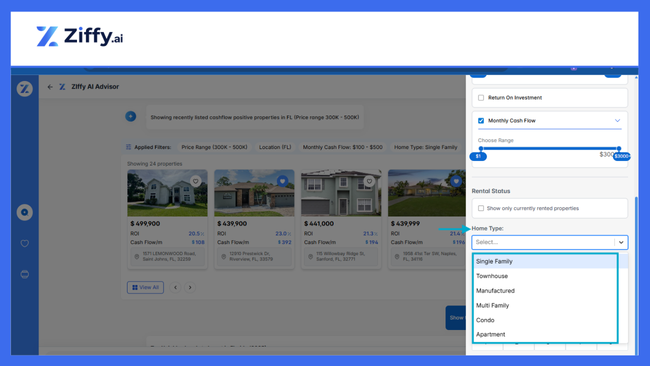

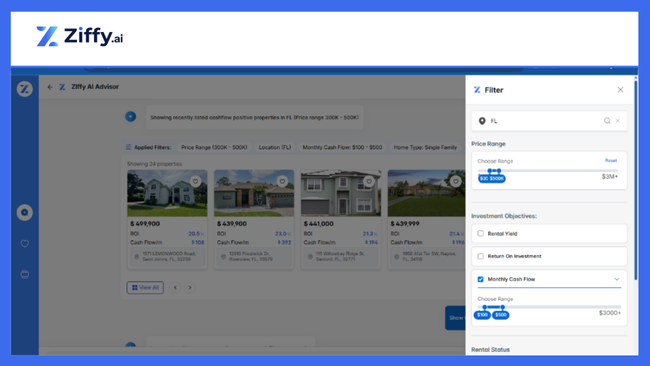

As you search for properties on Ziffy.ai, use smart filters like ROI and cash flow using ZiffyAI to instantly surface investments that match your strategy.

How to Research and Choose the Right Market For Your Real Estate Investment

A great investment in the wrong real estate market is still a bad deal. The city or neighborhood you choose shapes your rental income, long-term appreciation, tenant pool, and even your renovation costs.

That’s why seasoned investors always start with the market, not the property.

Focus on Fundamentals

Before narrowing down locations, look for signs of economic and housing strength:

- Job and population growth suggest long-term demand

- Low vacancy rates signal strong rental markets

- Steady appreciation points to rising property values

- Balanced price-to-rent ratios help you identify where rents support property prices

- Local regulations affect everything from short-term rentals to eviction laws

The goal isn’t to find a perfect market. It’s to find one that supports your chosen strategy. A city with growing rents and stable tenants may be perfect for long-term rentals, while areas with undervalued homes and active buyers might suit a flip.

Make Data-Driven Comparisons on Ziffy.ai

Once you’ve short-listed a few markets, compare them side by side. Look at rental yield projections, neighborhood trends, and price movement over time. On Ziffy, you can check all of this in one place.

How to Analyze a Real Estate Investment Property and Evaluate Risk

Once you’ve found a market that fits your strategy, the next step is knowing how to evaluate the actual properties. It’s easy to get excited by photos, listing descriptions, or projected returns, but good investors look past the surface.

They dig into the numbers, assess the risks, and ask the right questions before moving forward.

Start With the Fundamentals

Begin by asking: does this property make financial sense based on how I plan to use it?

If it’s a rental, you want to know how much cash flow it can generate after covering all costs, not just the mortgage. If you’re flipping, you need to understand the renovation scope, resale potential, and time to market.

At a minimum, focus on:

- Monthly cash flow: Will rental income cover all expenses and leave you with a profit?

- Cap rate: Does the property’s income justify its price?

- Upfront costs: What will you spend beyond the down payment? Consider repairs, closing fees, and reserves.

- Exit strategy: If things don’t go as planned, do you have a way out without losing money?

Think in Scenarios, Not Snapshots

Every deal carries risk, such as vacancy, maintenance surprises, market shifts. The goal isn’t to eliminate risk but to understand it. Run your numbers assuming things don’t go perfectly. What happens if rents drop by 10 percent or if repairs cost more than expected?

On Ziffy.ai, you can compare properties based on long-term income projections and upfront cash needed, among others.

Numbers matter, but what counts even more is seeing the bigger picture and making decisions with clarity instead of guesswork.

Financing Your First (or Next) Real Estate Deal

Your financing strategy is just as important as the property you choose. It’s not just about securing a loan, it’s about structuring your capital in a way that maximizes returns, protects cash flow, and supports your long-term goals.

If you’re investing for the first time, the process can feel difficult to understand. There’s no universal playbook, and most advice out there is generally targeted toward homebuyers, not investors.

But here’s what experienced investors do differently.

- They Start With the Numbers, Not the Loan

Experienced investors don’t search for a loan first. They start by analyzing the investment to understand what kind of financing fits best.

For long-term rentals, you might prioritize fixed payments and long-term stability. If you’re investing in a property that needs renovation or will be sold quickly, flexibility and fast closing become more important than low monthly costs. And if you’re scaling your portfolio, you’ll want financing that helps you preserve capital across multiple opportunities.

On Ziffy, you can model different financing scenarios while evaluating investment opportunities. You’ll see how monthly payments, down payment amounts, and income affect your return. It’s not theoretical. It’s your investment, shaped by data that helps you move forward with clarity.

- They Understand That Financing Shapes the Deal

How you finance determines more than just your monthly payment. It affects your:

- Cash-on-cash return

- Timeline to profitability

- Ability to reinvest or scale

- Risk exposure during vacancy or turnover

That’s why Ziffy doesn’t treat financing as a separate step. Instead, it’s embedded into the investment workflow. Every investment property you analyze comes with integrated financial analysis so you can choose the structure that supports your strategy, not the other way around.

Managing the Investment After You Buy

Buying the property is only the beginning. What separates a successful investor from someone who just “owns real estate” is how well they manage that investment over time.

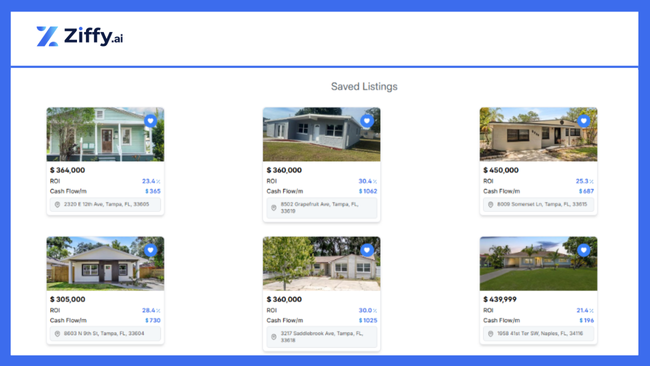

Whether it’s your first rental or part of a growing portfolio, staying on top of operations, income, and expenses is what protects your returns and builds long-term value.

Focus on Three Key Areas

1. Tenant and Property Management

If your investment is a rental, tenant quality directly affects your cash flow. Screening applicants, setting clear lease terms, and maintaining the property proactively will save you time, money, and stress. You don’t need to be hands-on with every task, but you do need a system whether that’s a trusted manager or a self-serve approach.

2. Financial Oversight

Even profitable investments can bleed money if you don’t monitor the numbers. Track your rent payments, maintenance costs, insurance, property taxes, and loan servicing. Missed details add up quickly. On Ziffy.ai, your investor dashboard gives you a centralized view of your income and expenses, so you can see exactly how each investment is performing in real time.

3. Planning the Next Move

Good investors don’t just collect rent, they plan for growth. That could mean refinancing to pull out equity, upgrading the property to increase rental income, or selling when the time is right. By tracking your property’s performance over time, you’ll know when to hold, when to improve, and when to move on.

Ziffy supports this full lifecycle. From cash flow alerts to refinance prompts and ROI projections, everything is designed to help you manage efficiently and with confidence.

Final Thoughts: Start Smart, Grow Confidently

Real estate investing doesn’t have to be overwhelming. With the right strategy, smart tools, and clear insight into each investment, you can build long-term wealth on your terms. Whether you’re buying your first rental or adding to your portfolio, the key knowing what to look for, what to avoid, and how every piece fits together.

Ziffy is built to support that clarity. From AI-driven investment property search, market research and financing to analysis and ongoing management, everything you need to succeed as an investor is in one place.

FAQs

Can I invest in real estate if I don’t have a high income?

Yes. Many investment options are available that don’t require six-figure salaries. The key is understanding what you can finance, what return you need, and choosing a strategy that works with your resources. Ziffy.ai helps you find properties with its AI-driven investment property search and financing combinations that match your goals and budget.

What’s the best real estate strategy for beginners?

There’s no one-size-fits-all answer. Buy and hold rentals are often a good entry point due to their long-term stability, but house hacking or short-term rentals can also be strong starting strategies. Use Ziffy to explore different approaches and compare them based on your income goals and time commitment.

How do I know if a property is a good investment?

Start by analyzing cash flow and projected return on investment. Look at both income and expenses, and consider market trends. On Ziffy, you can run these numbers for each property in real time to help you make informed decisions.

What if I want to invest out of state?

Investing out of state is common and can be a smart way to tap into stronger markets. You’ll want to pay extra attention to local laws, management options, and data-driven research. Ziffy allows you to compare markets side by side and identify cities that match your strategy.

![A Beginner’s Guide to Real Estate Investment [Bonus: Smart Tools From Ziffy.ai]](https://ziffy.ai/learn/wp-content/uploads/2025/10/ABeginnersGuideToREInvestment-500x325.jpg)