Editorial Integrity

Making sound real estate investment decisions begins with reliable, data-driven insights. At Ziffy.ai, we offer an AI-powered investment property search platform, proprietary data-driven trend analysis, investment mortgage programs like DSCR loans, and a network of over 500 investor-friendly real estate agents to deliver the expertise needed for informed decisions. Our content is crafted by experienced real estate professionals and backed by real-time market data, ensuring you receive accurate and actionable information. Through a rigorous editorial process, we strive to empower your investment journey with trustworthy and up-to-date guidance.

Key Takeaways:

1. Buy and Hold creates both cash flow and long-term equity. You earn monthly income from rent while property values appreciate over time, building wealth through both income and asset growth.

2. Market selection determines long-term success. Focus on areas with job and population growth, strong rent-to-price ratios, and low vacancy rates to ensure consistent returns and appreciation.

3. Smart financing keeps your cash flow positive. Aim for around a 20 percent down payment, account for closing costs, and maintain cash reserves to handle vacancies or repairs without stress.

4. Ziffy simplifies deal analysis and property comparison. You can track rental yield, cap rate, appreciation, and DSCR for every listing, helping you find properties that align with your strategy.

Table of Contents

Some investors chase quick flips. Others chase trends. But the smart ones? They buy right, hold long, and let time do the heavy lifting.

Buy and Hold is one of the most powerful real estate investment strategies out there. It’s about stacking cash flow, riding long-term appreciation, and building a portfolio that works for you while you sleep.

In this guide, we’ll break it all down and show you how to pick the right markets, run the numbers, and grow your wealth with Ziffy’s tools by your side.

What Is the Buy and Hold Real Estate Strategy?

Buy and Hold is exactly what it sounds like: you buy a property, rent it out, and hold onto it for the long haul while it builds equity and generates passive income.

Unlike flipping, where the goal is quick resale profit, Buy and Hold is a slow-burn strategy that lets you earn in two ways at once:

The longer you hold, the more powerful this combo becomes, especially when you’re using Ziffy’s tools that help you track ROI, manage financing, and stay cash flow positive from day one.

Buy and Hold vs Fix and Flip: Which Strategy Builds More Long-Term Wealth?

Feature | Buy and Hold | Fix and Flip |

|---|---|---|

Investment Timeline | 5 – 30 years | 6 – 24 months |

Income Source | Monthly rental income + long-term equity | One-time resale profit |

Risk Level | Lower (if property is well-managed) | Higher (depends on renovation + market) |

Tax Benefits | Strong (depreciation, interest deductions) | Limited (mostly short-term capital gains) |

Ideal For | Wealth building, retirement planning | Active investors with renovation skills |

If you’re aiming to build stable income and long-term gains, Buy and Hold gives you more control and predictability. And when you use tools that let you track cash flow, compare deals, and project long-term returns in one place, staying the course becomes a lot easier.

Clarify Your Investment Goals Before You Buy

Every successful Buy and Hold strategy starts with a clear vision. Are you investing to build long-term cash flow that replaces your day job? Or are you more focused on appreciation and growing equity you can tap into later?

Your investment goals shape your entire approach; what markets you choose, what kind of property you buy, and even how you finance it.

For example:

On Ziffy, you can filter listings and check the rental yield, cash flow strength, or appreciation, so whether you’re optimizing for income or long-term gain, your property search reflects your bigger plan.

How to Choose the Right Markets for Buy and Hold Investing

The market you invest in will make or break your Buy and Hold strategy. A great property in the wrong zip code won’t generate the returns you need, while a modest home in the right market can cash flow and appreciate steadily for years.

What exactly makes a market “right” for long-term investing?

Here are the metrics that matter most:

With Ziffy, these data points are built directly into your property search. You can view rental yield and appreciation forecasts for each listing without the need to maintain a spreadsheet or do any external research.

Budgeting and Financing Your Buy and Hold Investment

Once you’ve zeroed in on your target market, the next move is to look at the financing.

Start by clarifying your budget:

From there, explore your financing options. On Ziffy, you can get pre-approved directly through the platform with loan options designed for long-term rentals.

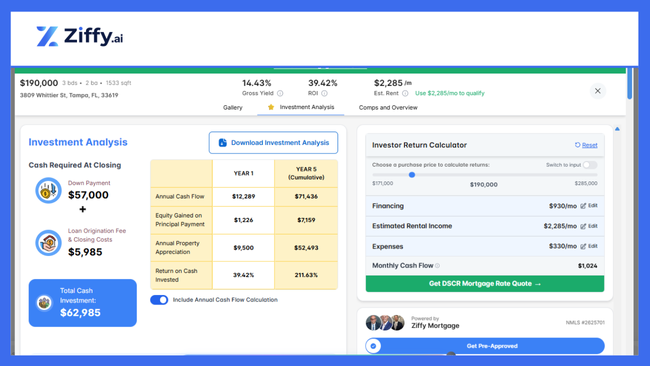

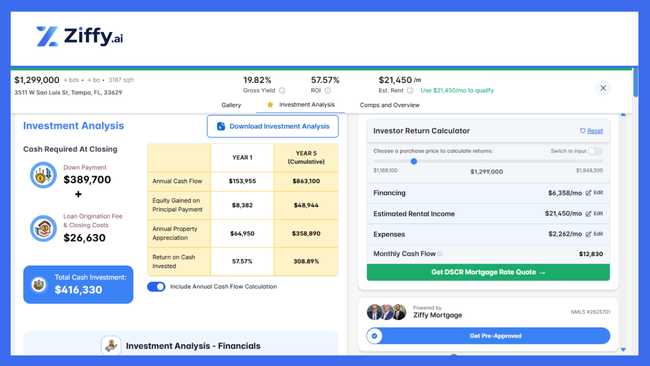

You’ll see terms, estimated monthly payments, and DSCR metrics as you browse properties, so you’re not just looking at listings, you’re looking at how those listings fit into your financial strategy.

The best part? Everything updates in real time, so if you adjust your down payment or rental assumptions, your numbers change with you.

How to Find the Right Property for Buy and Hold

With your budget and financing lined up, it’s time to look for the property that checks all the right boxes. But not every home that’s for sale makes a good long-term rental. The key is to find one that balances cash flow with appreciation potential.

When searching for Buy and Hold properties, here’s what to focus on:

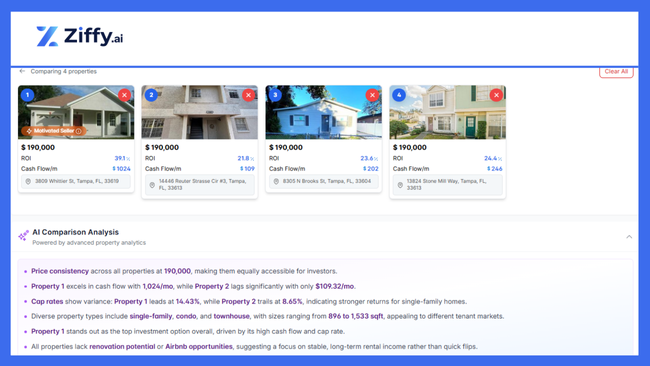

Ziffy makes this process easier by letting you check all these metrics for each of the properties that you select. As you scroll through listings, you can sort by estimated rental yield, forecasted appreciation, cap rate, and even how fast similar properties have rented in the area.

Let’s say you’re targeting a high-cash-flow rental in Tampa. You can set a minimum rental yield, plug in your expected down payment, and immediately see how each listing performs.

And if you’re unsure which property makes more sense, you can compare them side by side. You’ll see projected returns and monthly cash flow estimates all in one place.

How to Analyze a Buy and Hold Deal Like a Pro

You’ve found a property that looks promising, but before you move forward, it’s time to check the numbers.

Instead of summarizing terms you’ve already seen, focus on what matters most:

Ziffy’s built-in analyzer helps you move past guesswork. You can run scenarios based on your financing terms, adjust your hold period, and instantly see how it impacts projected ROI.

You’ll also get clarity on breakeven points, long-term profit potential, and risk flags that might otherwise be easy to miss.

Also, because everything is centralized, you’re not moving between tabs trying to stitch it all together.

Final Checks Before You Commit

Before locking in the deal, take a moment to validate the fundamentals.

Make sure the rent projections are realistic, the neighborhood fits your long-term strategy, and your reserves are strong enough to weather vacancies or repairs. If the inspection reveals any red flags, reassess the financials, and not just the price, but the potential timeline for repairs or rent-ready upgrades.

For a full breakdown of what to do before closing, including legal checks, payment flow, and documentation, see our full Closing Day Checklist here.

Final Takeaway: Build Wealth with Strategy, Not Guesswork

Buy and Hold isn’t about chasing the hottest trend. It’s about playing the long game, making decisions based on data, not emotion, and using the right tools to stay consistent year after year.

Whether you’re after steady cash flow, equity growth, or a scalable rental portfolio, the key is clarity. When you know your goals, choose the right markets, and analyze your deals with discipline, long-term returns follow.

Ziffy helps you do all of that in one place, from finding properties that match your strategy to tracking your investment performance as you grow.

FAQs

What is the best type of property for Buy and Hold investing?

There’s no one-size-fits-all answer, but single-family homes and small multifamily properties (like duplexes or triplexes) are often ideal for beginners. Look for properties in stable neighborhoods with strong rental demand, low vacancy rates, and consistent appreciation over time.

How do I calculate ROI for a Buy and Hold property?

Your return on investment (ROI) typically includes both cash flow and property appreciation. Ziffy’s investment analyzer helps you check the property’s ROI, rental income, expenses, loan terms, and projected value growth based on your hold period.

How long should I hold a rental property?

Many investors hold properties for at least 5 to 10 years to fully benefit from appreciation and mortgage payoff. That said, if the market shifts or a refinancing opportunity arises, it’s worth reviewing your hold strategy annually.

Can I finance a Buy and Hold property without a traditional W-2 income?

Yes. You don’t need a conventional 9 – 5 job to qualify for investment property financing. What matters most is the property’s ability to generate income. On Ziffy, you can explore financing options based on rental cash flow and property performance, with tools that help you assess eligibility and run numbers even if you’re self-employed or earning from multiple sources.

At Ziffy, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant.

U.S. Bureau of Labor Statistics: CPI